In the management of any budget, the most important thing is the ability to think long-term. Lack of this experience is the root of all problems. By nature, people are bad at planning because they are used to living in the present. However, this is not so difficult to fix, because now there are many ready-mades, proven approaches, techniques, and even emergency loans online.

Mastering financial literacy at the personal level will allow you to work more effectively in management. The chief agronomist must be able to calculate all the costs necessary for a successful sowing season. From fuel and labor costs to the cost of fertilizers, seeds, pesticides, and other deductions.

How to Organize the Accounting of Personal Finances

First of all, you need to record all planned revenues and expenses in the current month. This will help create the overall financial picture. Even if you have a good memory, a detailed spending plan cannot be kept in your head.

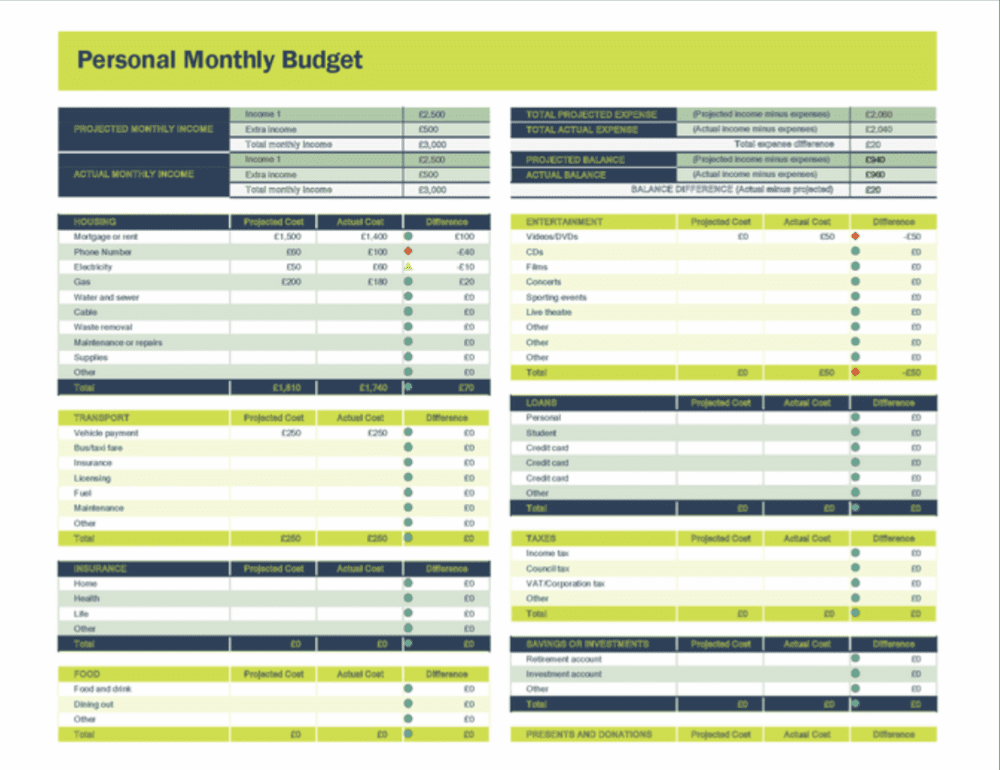

How to do it? To begin with, on paper or in Excel Budget Spreadsheet, whichever is convenient, make the table with all receipts and expenses. It is important to think carefully about aspects of life and not to miss anything.

Although at first, of course, there will be drawbacks. It is impossible to make clear and correct planning at once. If you find any flaws, you should record them in the notes. This approach will help improve the budget for next month.

Actions to Help Manage the Budget

Any trip to the store should be planned. A shopping list and the most accurate adherence to it will help save money. It is useful to make a menu for a few days, based on which it will be clear how many products you need to buy and in what quantity. The ability to plan your expenses well is largely influenced by time management skills.

Cost Accounting

They can be written in a notebook, notebook or used in specialized applications on a smartphone. This helps identify unnecessary purchases and avoid them in the future;

Saving Money

There is always a risk of losing a steady income. It is important that in case of an emergency there is a stock that will help last for several months. It is desirable that it was at least three salaries.

Family Budget: Planning And Control of Home Finances

The well-being of the family largely depends on budgeting skills. Written planning rules are also needed here. Accounting for income and expenses, the ability to save — is no less important.

There is an interesting way to organize a family budget, it is called “10-20”. Its essence is a monthly deferral of at least 10% of total income. Financial experts advise setting the purpose of accumulation at once. For example, a vacation, a big purchase, or a reserve for a “rainy day”.

Seven Envelopes is another way to keep a family budget. On the day of payment, you need to distribute the money between seven envelopes. Their purpose may be as follows (items may be less or more, here everything is individual):

- Monthly payments;

- Food;

- Money for children;

- Expenses for significant purchases (furniture, appliances, clothing);

- Money for vacation, entertainment;

- Savings;

- “Joy” — funds remaining from the previous month after the mandatory purchases and payments.

Clear Up Purposes the Family Budget Is Distributed

The “Four Envelopes” method. This option is similar to the previous one. But here each envelope corresponds to the week of the month. The disadvantage of this method is the difficulty of allocating funds to specific costs.

To successfully manage a home budget, it is enough to follow 7 basic rules:

- Do not allow creditworthiness. If possible, avoid debts, unplanned loans, and bad credit cards;

- Reasonable accumulation and distribution of funds. Don’t collect just to collect. It is desirable to choose a specific goal (for example, buying a car). Such motivation will improve productivity;

- Each family member must clearly understand how and why the budget is planned;

- Allocate income and expenses following financial realities today;

- Be sure to save 10% of your income to the reserve fund;

- At the end of a certain period (for example, a year) to please the family with any trip, shopping, entertainment;

- Regularly, preferably monthly, to keep planning and accounting. Only stability will help to achieve the result.

Tools for Effective Financial Management

The way you manage your budget depends on your personal preferences and skills. Some people find it more convenient to write in a notebook, some people use a computer or smartphone.

If you do not have the opportunity or desire to use technological equipment, you need to start a “collar book” in paper form. The main part should consist of a table, which is divided into three columns (cost, income, total). The first two keep track of income and expenses. The last column is needed to compare the remaining funds with those in your pockets.

It will be much more effective to manage finances in specialized programs. Many of them have a version for both PC and smartphones, which allows you to synchronize and enter data at almost any time of day. The functionality of such software includes important functions. For example, it automatically creates reports, allows you to keep track of debts and loans in a convenient form, plan finances for the future, and save data on savings. Plus, many programs can add user profiles. That is, help to maintain a joint budget with all family members.

Tracking Expenses

If you decide to change and improve your family’s financial management system, start tracking expenses. For 3-4 months you keep track of your expenses, collect checks and write them down. The main goal is to find out “How much do I cost?” and “How Much Does My Family’s Life Cost?”

Without a good complete analysis, it is impossible to start effective money management. The Foundation recommends conducting a weekly or monthly joint cost analysis on three columns (necessary, required, and wanted) to answer the following questions:

- What does the family spend money on?

- What costs were extra? Which ones are needed?

- What could you save on?

- How much do we need, do we want?

Vigilance over cash receipts and expenditures is the basis of reasonable savings. Try to invest in targets to avoid overspending on cost items.

Each family must decide together how to properly distribute the family budget. For everyone to be interested in saving and fixing all expenses, choose a common goal for which you want to raise money, then this process will turn into a pleasant pastime, not boring control. Remember that the family budget allows you to save wisely and your perseverance will help make dreams come true and ensure a proper future for your children.