Privacy and Financial Security at Risk: McAfee Labs Warns of SpyLoan Applications

McAfee Labs has unveiled alarming findings about the surge in SpyLoan applications, a category of predatory loan apps exploiting social engineering tactics to compromise user privacy and financial security. These potentially unwanted programs (PUPs) target Android devices, posing risks that extend beyond individual users to impact entire regions.

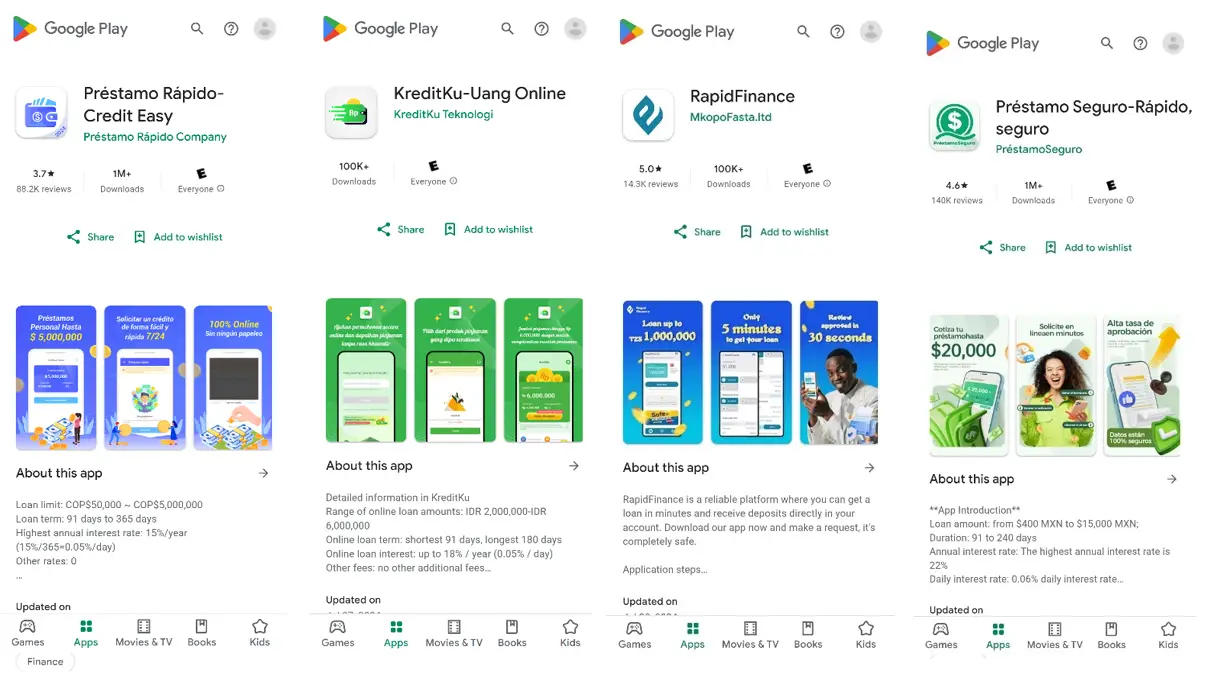

SpyLoan apps entice users with promises of quick loans at low interest rates, leveraging deceptive marketing tactics. “These apps primarily exist to collect as much personal information as possible, which they then may exploit to harass and extort users into paying predatory interest rates,” the report states. The onboarding process typically includes privacy policies with extensive data collection permissions and a countdown timer to create urgency.

The apps misuse granted permissions to access sensitive data, such as SMS content, call logs, and even contact lists. According to McAfee, “they require users to consent to collect excessive and exploitative data that a formal financial institution would not normally require.”

From mid-2024 to Q3, the number of SpyLoan apps surged by over 75%, with a combined download count exceeding 8 million. These apps have been detected globally, with hotspots in South America, Southeast Asia, and Africa. Countries like India, Mexico, and the Philippines rank among the most affected.

What sets SpyLoan apart is their shared codebase, infrastructure, and tactics. They encrypt and exfiltrate data to command-and-control (C2) servers using similar frameworks. The use of hardcoded AES-128 encryption, obfuscated strings, and dynamic privacy terms make detection and mitigation challenging.

The consequences of engaging with SpyLoan apps are severe, ranging from financial fraud to emotional distress:

- Financial Exploitation: Hidden fees, high interest rates, and unauthorized charges plague users. One victim described how apps “start calling and threatening you with edited photos and posting them on social media, even sending them to your contacts.”

- Privacy Violations: Personal data is often used for extortion, including threats and harassment of the victim’s friends and family.

- Psychological Impact: Victims report stress, anxiety, and reputational damage, with tragic cases like a suicide in Chile tied to harassment by these apps.

McAfee has worked closely with the App Defense Alliance and Google to address these risks. Many SpyLoan apps have been removed or updated to comply with Play Store policies. However, even updated versions remain problematic, with McAfee detecting them as Android/PUP.SpyLoan due to their ongoing risks to user privacy and security.

SpyLoan apps illustrate how cybercriminals exploit trust, urgency, and financial desperation. These threats emphasize the importance of digital literacy and stringent app store policies. McAfee advises users to verify app credentials, read permissions carefully, and report suspicious applications.

As Fernando Ruiz states, “By understanding how these malicious apps operate and taking proactive steps to protect ourselves, we can mitigate the risks and help others do the same.”