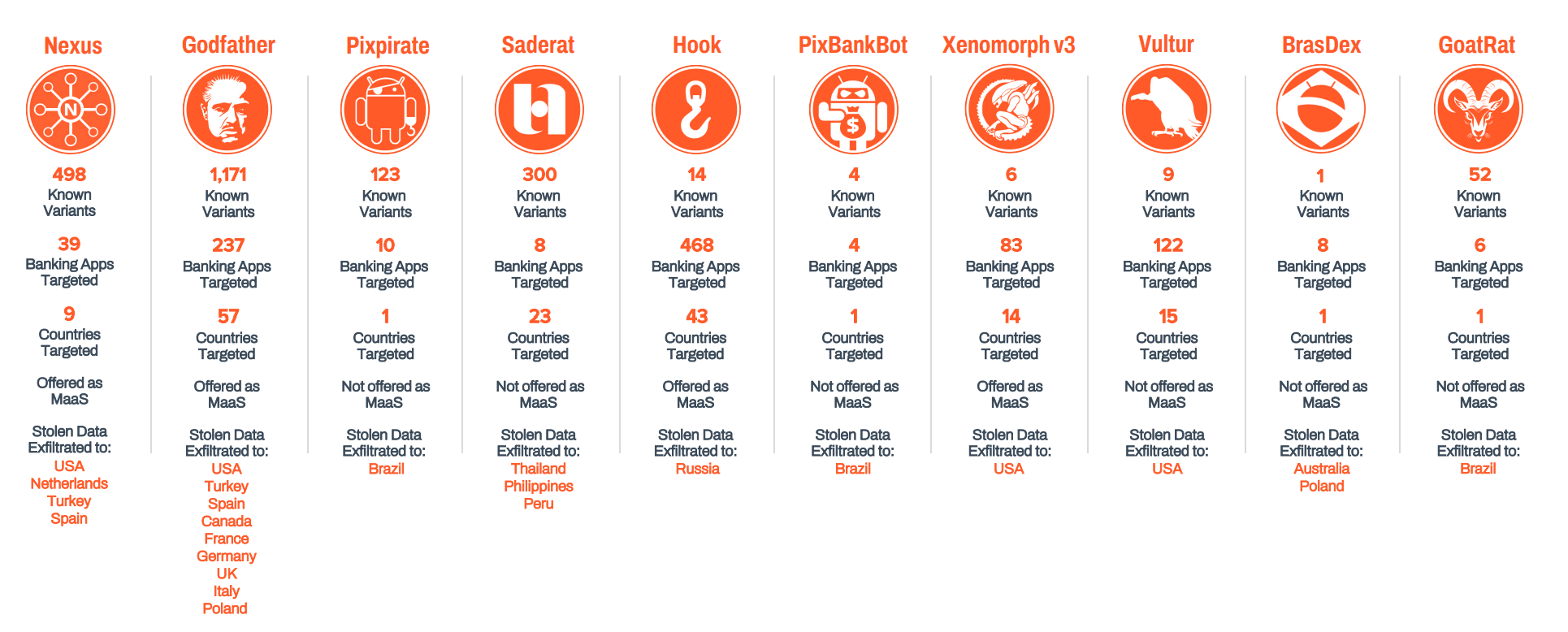

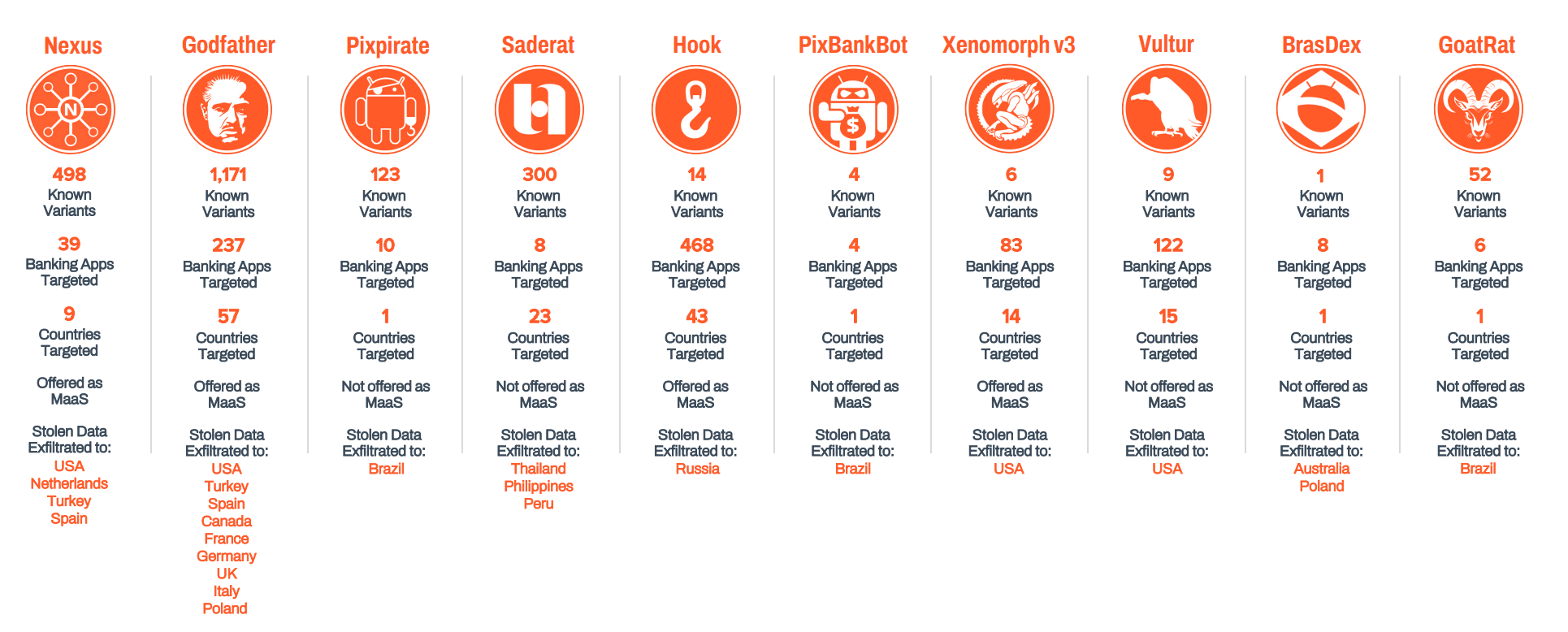

New Banking Malware Families | Image: Zimperium

In the fast-evolving world of mobile banking, a new report sheds light on a growing peril – the sophisticated and relentless threat of banking trojans. The 2023 Mobile Banking Heists Report, meticulously compiled by Zimperium, reveals a dramatic escalation in financial fraud, particularly targeting mobile banking applications.

The mobile banking market, with its trajectory set to reach $7 billion by 2032, is outpacing traditional online banking across all age demographics. This surge, however, is shadowed by a parallel increase in financial fraud, with rogue mobile applications identified as critical vectors in these attacks. The United States has seen a considerable rise in mobile fraud, accounting for 32% and 37% of all fraud, marking an increase of 5% and 12% respectively. The UK too has witnessed a 17% increase in fraud cases in just one year.

Zimperium’s research unfolds an alarming landscape, analyzing 29 banking malware families, including 10 new active families identified this year. These malware entities, targeting 1103 traditional banking apps and a growing number of FinTech and Trading apps, showcase a relentless pursuit of financial exploitation. The reach of these trojans spans 61 countries, highlighting their global impact.

The sophisticated nature of these threats is evident in their evolving capabilities, such as the Automated Transfer System (ATS) module, which automates fraud by extracting credentials and initiating unauthorized transactions.

Banking trojans, masquerading as legitimate apps, exploit banking applications on mobile devices. Their primary goal is to steal banking credentials, and financial information, and facilitate unauthorized transactions.

More than half of the malware families researched possess advanced capabilities like keylogging, screen overlays, and SMS-stealing, which increasingly compromise traditional security measures like strong passwords, domain-based security, OTP, and MFA.

The proliferation of malware variants, fueled by open-source malware and Malware-as-a-Service offerings, has overwhelmed traditional signature-based security approaches. For instance, the “Saderat” malware has over 28 variants that remain undetected by mainstream security solutions.

Moreover, most legitimate apps fall short in complying with standards like the OWASP Mobile Application Security Verification Standard, rendering them vulnerable to reverse engineering and tampering.

Modern threat actors use diverse channels like QR codes, SMS, social media, and even secure messaging apps to deliver phishing URLs, making them difficult to identify when combined with mobile and brand impersonation.

With banking malware outpacing traditional security measures, it is crucial to enhance mobile app security solutions. Features like real-time threat visibility, zero-day defense, on-device mitigation, and adaptive security are imperative to combat evolving threats.

The growing sophistication of banking malware poses significant economic impacts. For financial organizations, this translates into increasing fraud losses and operational costs, thereby affecting overall profitability. For consumers, it means an elevated risk of financial fraud and the need for heightened cyber hygiene.

The 2023 Mobile Banking Heists Report underscores a critical juncture in the digital banking era. As mobile banking applications become increasingly integral to our daily financial activities, the need for robust security measures and consumer awareness becomes paramount. Understanding the anatomy, impact, and trends of mobile banking malware is not just an industry necessity but a consumer imperative in safeguarding financial assets in the digital age.