Image Credit: Recorded Future

The 2023 Payment Fraud Intelligence Report unveils a concerning resurgence in the payment fraud landscape. Cybercriminals, rebounding from the 2022 crackdowns and geopolitical disruptions, have ramped up their activities. With 119 million stolen payment cards surfacing online, potential fraud losses are estimated at a staggering $9.4 billion, coupled with $35 billion in potential chargeback fees. This year witnessed an alarming sophistication in fraud techniques, including advanced social engineering, phishing scams, and refined cyber-tools. The report highlights key trends like the rise in Magecart e-skimmer attacks, targeting mainly US merchants, and the increasing use of Telegram for sharing stolen card data.

A notable shift in fraudsters’ modus operandi includes the use of advanced social engineering and cutting-edge cyber tools. Techniques like phishing, 3-D Secure bypass software, and meticulous new account fraud workflows have evolved to outsmart traditional fraud detection systems. This sophistication suggests that 2024 will witness an escalation in hybrid cyber-fraud threats.

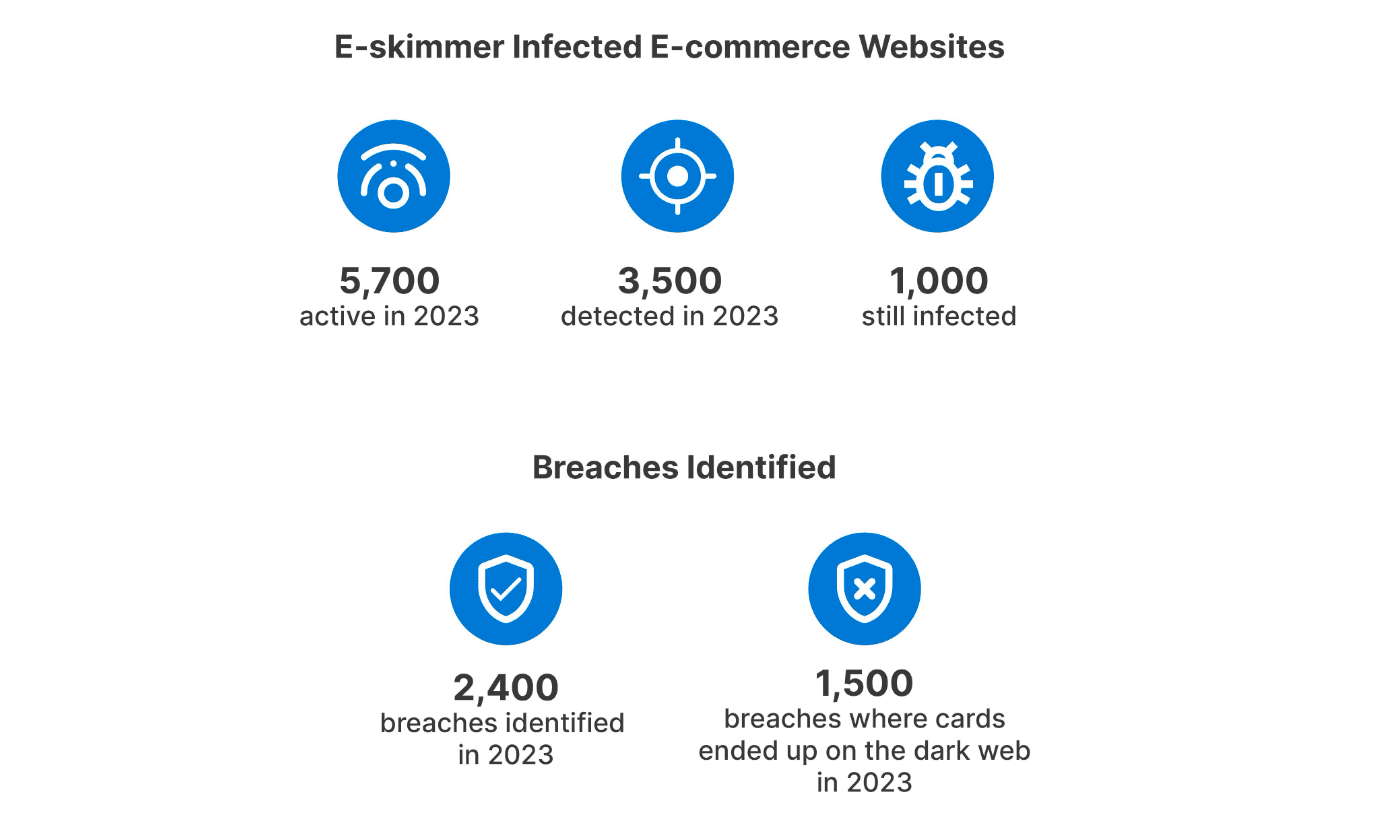

Financial institutions and stakeholders are advised to pivot towards a collaborative approach, integrating cyber threat intelligence (CTI) with fraud teams. A critical strategy involves creating an analytical loop, where the analysis of compromised cards by fraud teams helps CTI identify breach points, leading to the discovery of more compromised data. This fusion approach promises enhanced fraud prevention, although it may incur higher operational costs.

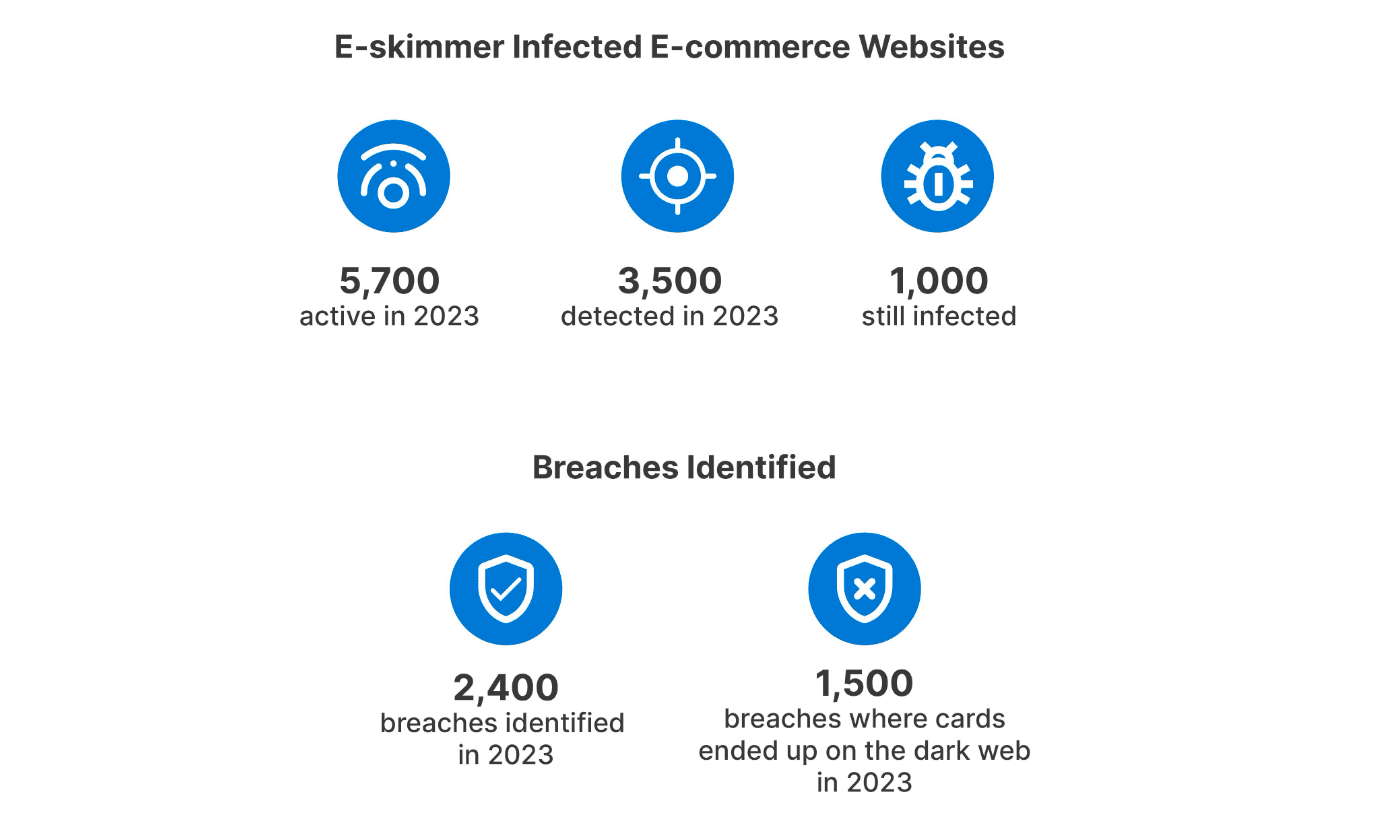

The report highlights the persistence of Magecart actors, exploiting tools like Google Tag Manager and Telegram Messenger. They continue to refine their skimming methods, majorly targeting US merchants. Telegram has also emerged as a crucial platform for sharing full card data. Importantly, AI and social engineering have become pivotal in cybercriminals’ arsenal, underscoring the urgent need for more nuanced fraud prevention strategies.

Key Takeaways:

- Stolen cards hit a record high: 119 million cards, representing $9.4 billion in potential losses, were posted for sale in 2023. North American and European cards took the top spot.

- Phishing and scams take center stage: Forget clunky malware, cybercriminals are now charming their way to your data with social engineering tactics.

- Magecart still reigns supreme: This e-skimmer king keeps evolving, hiding in familiar tools like Google Tag Manager and Telegram.

- 3DS bypass? Child’s play. Fraudsters are breezing past these security measures with alarming ease.

- AI joins the dark side: Generative AI is fueling new fraud schemes, creating realistic synthetic identities, and bypassing detection systems.

- Cyber-fraud fusion: the future of fighting back: Sharing intelligence between cyber threat and fraud teams is key to outsmarting these evolving threats.

Looking ahead, 2024 anticipates continued refinement of these fraudulent tactics. The report emphasizes the critical need for synergistic efforts between cyber threat intelligence and fraud teams, advocating for an ‘analytical loop’ for effective breach identification and prevention. This collaboration is poised to enhance fraud prevention efforts, though it may increase operational costs. In sum, the report provides a crucial roadmap for stakeholders to navigate and counter the evolving cyber-fraud landscape in 2024 and beyond.