On April 13, Coinsecure, the cryptocurrency exchange of India, disclosed that the platform’s 438 Bitcoins were stolen. Unlike previous thefts, the money stolen may not have been committed by hackers.

Coinsecure stated on the official website that the platform system has not been compromised and no traces of the invasion have been found. Saxena, the CSO (chief security officer) responsible for extracting Bitcoin, told them that the funds were unfortunately lost during the private key extraction process. This Saxena statement to the Coinsecure team is that the money was stolen from the company’s Bitcoin wallet due to an attack.

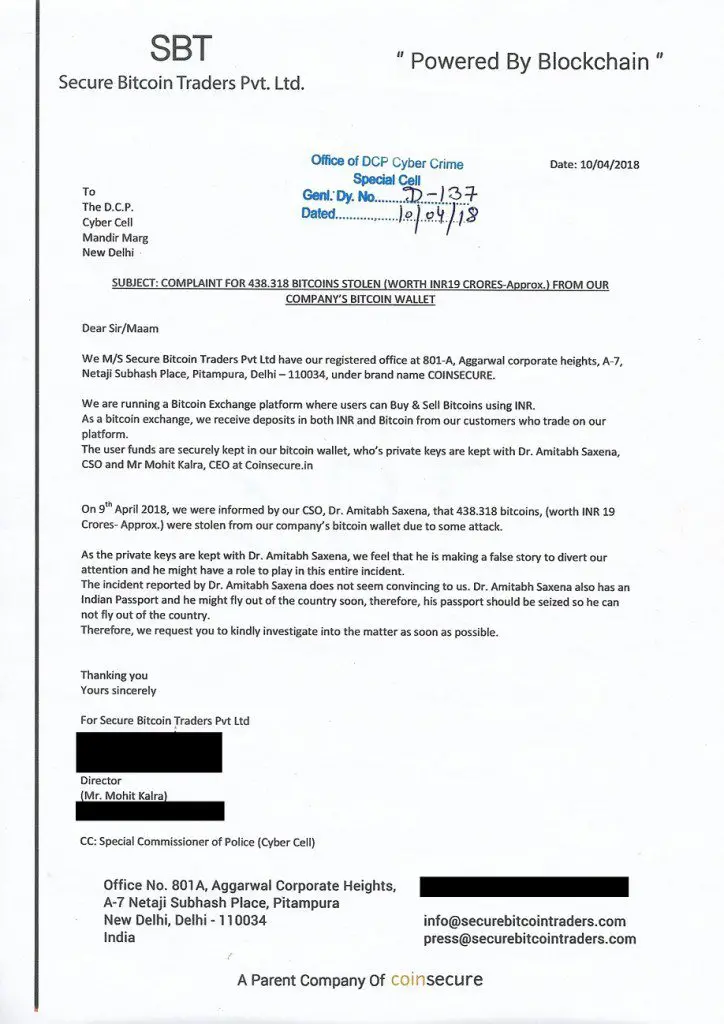

Mohit Kalra, the exchange’s CEO, had reported the incident to the police. The report was also posted on the official website. Kalra stated that the exchange’s private key was only for him and Saxena. The police in New Delhi requested that the Saxena passport is confiscated as soon as possible to prevent it from escaping.

Mohit Kalra, the exchange’s CEO, had reported the incident to the police. The report was also posted on the official website. Kalra stated that the exchange’s private key was only for him and Saxena. The police in New Delhi requested that the Saxena passport is confiscated as soon as possible to prevent it from escaping.

Coinsecure began as one of the first Bitcoin exchanges in India in 2014. They stated that the exchange was originally planning to introduce multi-currency support on the platform and recently launched Android and iOS operating system applications. However, the loss of money has changed everything. Although there is no official statement, Coinsecure may encounter the same fate as other exchanges that lost cryptocurrency. However, Coinsecure promises that no matter what happens, whether or not the funds can be recovered, they will compensate all customers for losses.

Coinsecure began as one of the first Bitcoin exchanges in India in 2014. They stated that the exchange was originally planning to introduce multi-currency support on the platform and recently launched Android and iOS operating system applications. However, the loss of money has changed everything. Although there is no official statement, Coinsecure may encounter the same fate as other exchanges that lost cryptocurrency. However, Coinsecure promises that no matter what happens, whether or not the funds can be recovered, they will compensate all customers for losses.

This case is the second case of cryptocurrency theft that occurred until this year. The early deaths of nano coins have not been completely dissipated so far and BitGrail is still closed. As a result, consumers who have suffered losses are still unable to recover their losses. The effectiveness of the legal funds sponsored by the Nano Fund needs to be observed. This time, if the third-party organization fails to find out the truth in a timely manner, Coinsecure’s fears are very likely to be realized – facing the fate of being shut down like BitGrail. In contrast, the nature of Coinsecure’s theft is different, and Coinsecure’s attitude towards customers is worthy of recognition.

As the technology matures and the currency market heats up, some countries have begun to issue cryptocurrencies with the guarantee of national credit. This is undoubtedly a disguised form of approval, and it also suggests that the future currency market may become fiery. The case of cryptocurrency losses in successive exchanges also reveals that in addition to the need for currency issuers and trading systems to ensure their security, relevant market transaction rules and laws and regulations are also urgently needed to be established and improved in cryptocurrency passage areas.

Source: cryptoglobe