Fake trading application named “Provex”

The digitalization of financial markets has brought increased investor access but also heightened vulnerability to cybercrime. India, a burgeoning hub for digital innovation and investment, has recently found itself in the crosshairs of a sophisticated and heartless scam known as “Pig-Butchering.” Originally emerging from China in 2020, this malevolent force has rapidly proliferated across Asia, leaving a trail of financial ruin and shattered trust.

At the heart of this scam are counterfeit Android and iOS applications, mirages of legitimacy, promising unsuspecting investors the keys to the kingdom of wealth. These applications, meticulously designed to impersonate well-known trading platforms, serve as the bait, enticing victims with the allure of high returns. The reality, however, is a brutal swindle that has siphoned over $75 million from hopeful traders worldwide between 2020 and 2024, according to a recent Bloomberg report.

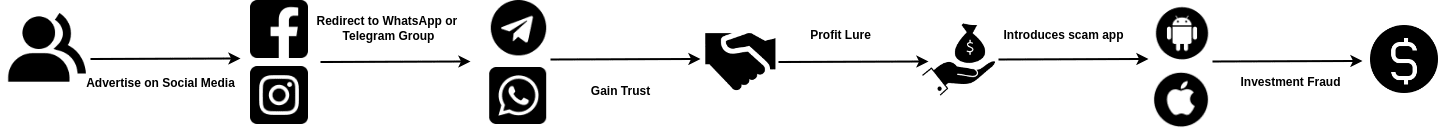

The scam’s modus operandi involves a cruel blend of social engineering and digital manipulation. In India, Cyble Research and Intelligence Labs (CRIL) has observed a significant uptick in these fraudulent schemes. Scammers cast a wide net through social media platforms like Facebook and Instagram, deploying enticing advertisements that promise lucrative stock market returns. These scammers cultivate trust through WhatsApp or Telegram groups, initially doling out genuine stock recommendations to build credibility. Yet, the narrative soon shifts as they introduce their rogue trading applications, urging victims to pour in more funds under the guise of amplified returns.

The moment substantial investments anchor within these phantasmal platforms, the illusion dissipates. Withdrawals become impossible, communication lines go dark, and the applications vanish, leaving investors in a financial and emotional abyss.

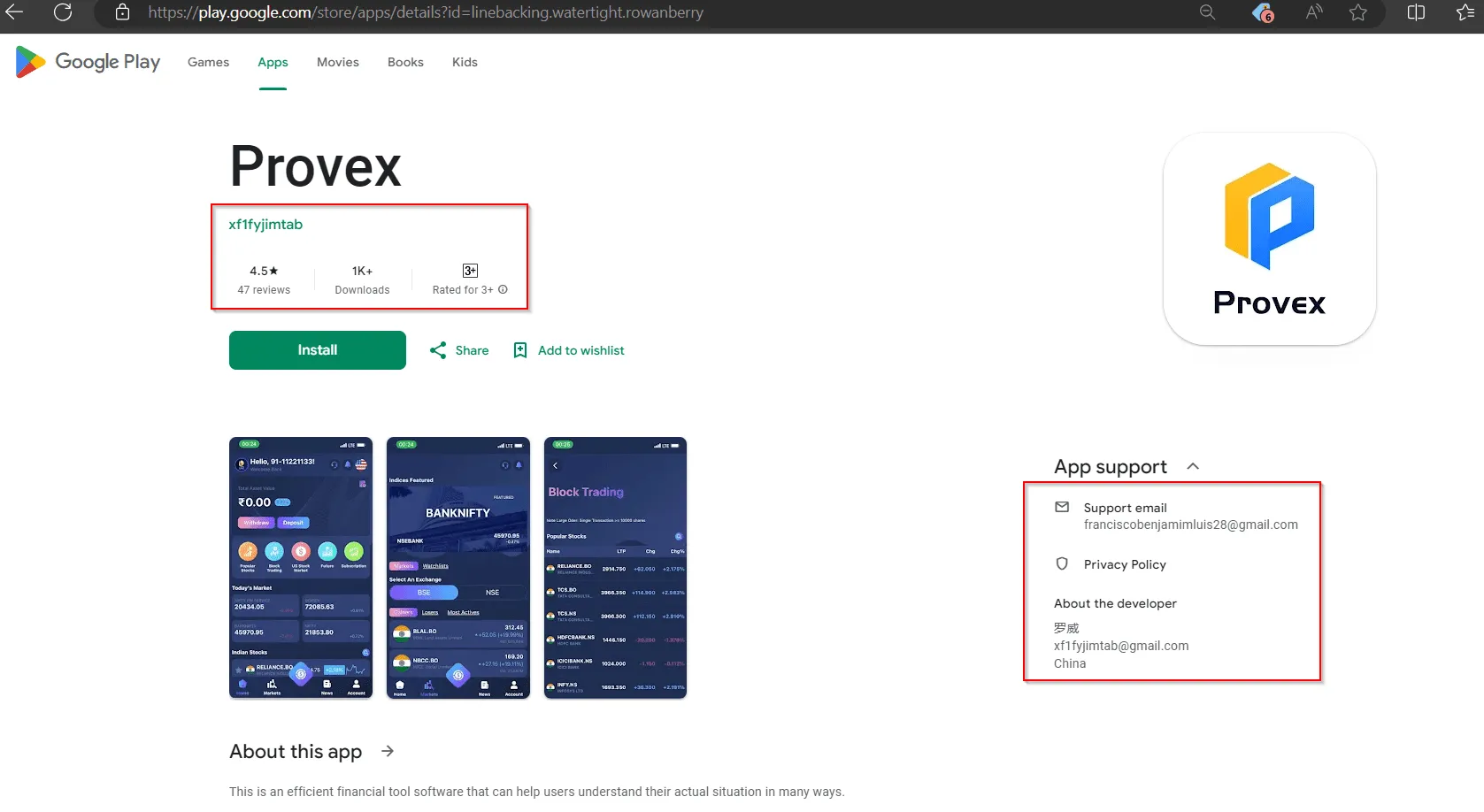

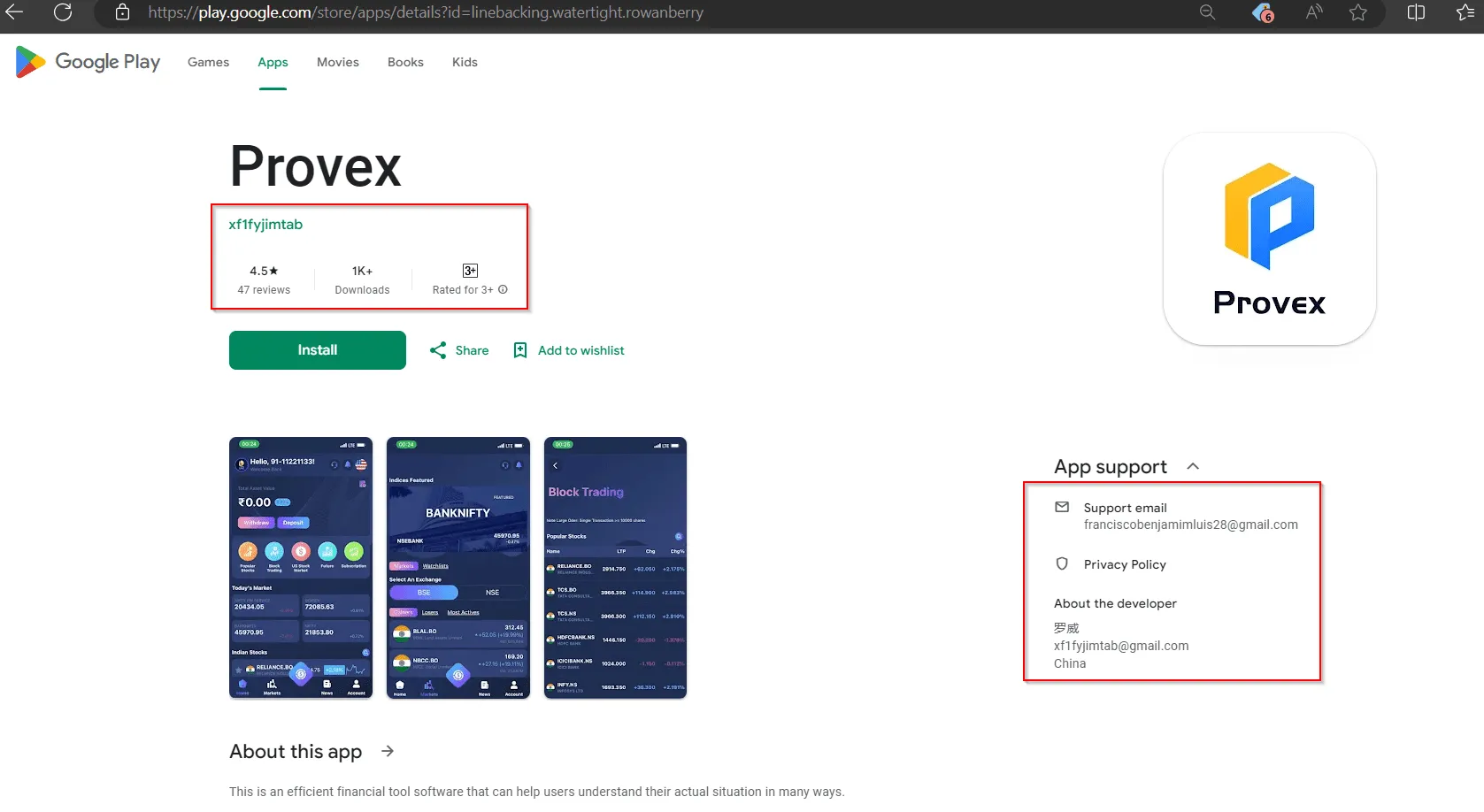

CRIL’s investigation brought to light several sham applications proliferating through official channels like the Google Play Store and App Store. Among them, “Provex” stands out, an app that has beguiled over a thousand users with its 4.1-star mirage. Beneath its surface, however, lies a cesspool of deception, including fabricated partnerships with industry giants like BlackRock to feign credibility.

These applications often rebranded and redistributed under various developer IDs, share commonalities that betray their sinister nature. For example, identical email IDs within the support sections hint at a centralized orchestration.

While India faces a surge in these pig-butchering scams, the phenomenon is not confined by geography. Similar tactics have been deployed in Taiwan, Korea, and beyond, highlighting a network of deceit with global ambitions. Notably, recent law enforcement actions in India against individuals linked to these schemes, including the arrest of a Chinese national with a hoard of SIM cards.

The pig-butchering scam shares its DNA with the emerging “Telegram Task Scam,” exploiting human vulnerability through promises of easy earnings for menial online tasks. This scam gradually escalates its demands, leading victims down a rabbit hole of fake crypto investments and fabricated financial platforms, culminating in substantial financial losses under the guise of boosting one’s “Credit Score.”

These schemes not only plunder financial assets but also erode trust in digital platforms and investment ecosystems. The allure of swift wealth, juxtaposed with cunning manipulation tactics, often clouds judgment, leading many into the trap set by these modern-day financial predators.

Protective Strategies

- Due Diligence: Utilize well-established, regulated brokers and exchanges. Conduct independent research of platforms, including checking regulatory licenses and online reviews.

- Data Prudence: Protect your sensitive information. Refrain from engaging with unfamiliar individuals on online platforms.

- Report Suspicions: Immediately notify the relevant authorities and the platform where you encountered potential fraud.

- Awareness is Key: Educate others on these scam tactics to minimize their potential impact.