Image: KrebsOnSecurity

Three UK adolescents have confessed to operating an online service that facilitated large-scale banking fraud by enabling criminals to circumvent multi-factor authentication protocols. The service, known as OTP Agency, was active from September 2019 until March 2021 and is estimated to have impacted over 12,500 individuals, with potential losses ranging from tens of thousands to millions of pounds.

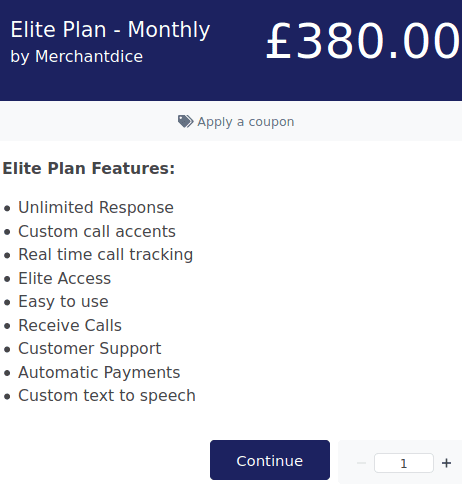

The perpetrators, Callum Picari (22), Vijayasidhurshan Vijayanathan (21), and Aza Siddeeque (19), offered subscription-based access to tools that allowed criminals to manipulate bank account holders into revealing one-time passwords and other sensitive information. The service targeted major UK banks and even provided access to Visa and Mastercard verification sites.

The National Crime Agency (NCA) led the investigation, culminating in the arrest of the three individuals in March 2021. All three were charged with conspiracy to manufacture and distribute fraud tools and money laundering. After initially denying their involvement, they have now pleaded guilty. Sentencing is scheduled for November 2, 2024, at Snaresbrook Crown Court.

This case underscores the growing sophistication of cybercrime and the critical importance of robust online security measures. The NCA urges all individuals to exercise caution when sharing personal information online and to remain vigilant against potential fraud attempts.

Related Posts:

- A former NSA contractor pleaded guilty to stealing 50TB of confidential data plans

- Cards on the Dark Web: Payment Fraud Booms Back in 2023

- Cybercrime Crackdown: U.S. Captures Russian Trickbot Malware Developer