A recent report by Parametrix, a leading cloud monitoring and insurance firm, has revealed the staggering financial fallout of the July 19th CrowdStrike outage. The report estimates that Fortune 500 companies, excluding Microsoft, have incurred a direct financial loss of $5.4 billion due to the disruption.

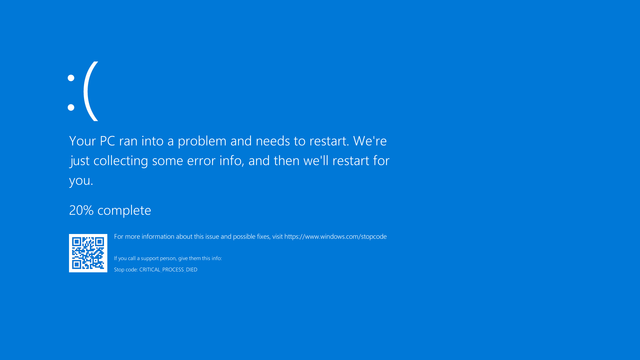

The outage, triggered by a faulty software update, caused widespread system failures across various industries. While the average loss per company is estimated at $44 million, the impact varied significantly across sectors.

The healthcare and banking sectors bore the brunt of the outage, accounting for 57% of the total losses. Healthcare giants suffered a staggering $1.938 billion in losses, while banking firms incurred $1.149 billion.

In contrast, the manufacturing sector, despite being the largest by revenue, experienced a relatively minor loss of $36 million. This resilience can be attributed to the sector’s reliance on traditional on-premises systems, which proved more resilient than cloud-based infrastructure.

The airline industry also suffered significant losses, totaling $860 million. The outage led to widespread flight cancellations and delays, causing a ripple effect throughout the travel industry.

Parametrix’s analysis also sheds light on the limitations of cyber insurance in mitigating such large-scale losses. Due to high deductibles and low policy limits, the portion of the loss covered by insurance is expected to be between 10% and 20%.

This incident underscores the need for businesses to reassess their risk management strategies and invest in robust backup and recovery systems. It also highlights the importance of diversifying technology infrastructure to minimize the impact of future outages.

“Our analysis of the CrowdStrike outage shows not only the possible extent of a systemic cyber loss event, but also its boundaries,” said Jonatan Hatzor, co-founder and CEO of Parametrix. “It tells us more about the ways that insurers and reinsurers can diversify their cyber risk portfolios to minimize the potential impacts of systemic cyber risk. However, our analysis does not show the whole diversification picture. A cyber insurer focused on very large companies will certainly suffer a much greater CrowdStrike loss relative to premium than one with a large SME book.”

Parametrix’s report, based on extensive data analysis and real-time monitoring, provides valuable insights into the financial consequences of technology disruptions. As businesses increasingly rely on cloud-based systems, the need for comprehensive risk mitigation strategies has never been more critical.

Related Posts:

- CrowdStrike Outage: Microsoft Points Finger at EU Agreement

- Hacker attack on Xplain: Swiss Govt. Data Exposed in Report

- Linux Users Hit by CrowdStrike Fallout: Kernel Panics Reported